- July 3, 2023

- Posted by: Jain R S and Associates

- Categories:

Gumasta License Bhopal is also known as the Shops and Establishment act license which is required to operate any shop or commercial establishment in India. And, today in this article we’ll put in the picture the meaning, fees and the registration procedure of Gumasta license.

What do we mean by Gumasta License in India?

Gumasta license is a kind of registration that is required for doing any kind of business in the state of MP that is governed by the Municipal Corporation of Bhopal under the MP Shops and Commercial Establishment Act,

It is a kind of certificate that provides you with the upper hand to do your business at a particular place.

Getting Gumasta license ensures the growth of your business and helps you to jump of the hurdles that may come in your path. Furthermore, it is also important for opening the current account or obtaining any loan for your business because without the license you will unable to get any loan and even GST registration will also not possible.

Gumasta License Registration

Under the MP Shop and Establishment act, Gumasta license is mandatory by all employer having 10 or more employees in the shop. And on the submission of the application, the concerned officer will inspect and after the verification will register the establishment in the register of establishment and issue a registration certificate along with the Labor Identification Number.

Now, the question arises what is the procedure for registration under Gumasta License.

Benefits of Gumasta License

As the license for establishing any form of shop and establishment is governed by the MP council, an applicant requires the Gumasta License to carry out any work coming under the purview of the establishment. There are different benefits of taking a Gumasta license in MP:

Tax and Subsidies-

Once this license is taken out the applicant can avail different form of tax and subsidies that is offered by the government of Maharashtra. Such tax and subsidies would only be available to the applicant after securing the Gumasta License.

Proof-

Once the applicant takes out the Gumasta License in MP, the applicant can start the operations of the business. This not only serves the purpose of a license but also acts as proof for carrying out business operations.

Compliance with Law-

Any business requiring registering under the respective shops and establishments act would have to comply with the requirement of taking a Gumasta License in MP.

Bank Account-

Once this license is taken out, the applicant can easily open a bank account. One of the main reasons for securing this form of license is that many businesses carry out transactions and require a bank account. Banks require the applicant to have this form of license to open a bank account for the business.

Regulatory Authority / Body for Gumasta License

The primary regulatory body or authority for the Gumasta License in MP is the Municipal Corporation of Bhopal and the MP Shops and Commercial Establishments Act. The main law related to Gumasta license is the MP Shops and Commercial Establishment Act, 1948.

An applicant before starting a shop or commercial establishment in MP requires this form of license to comply with the rules of relevant authorities.

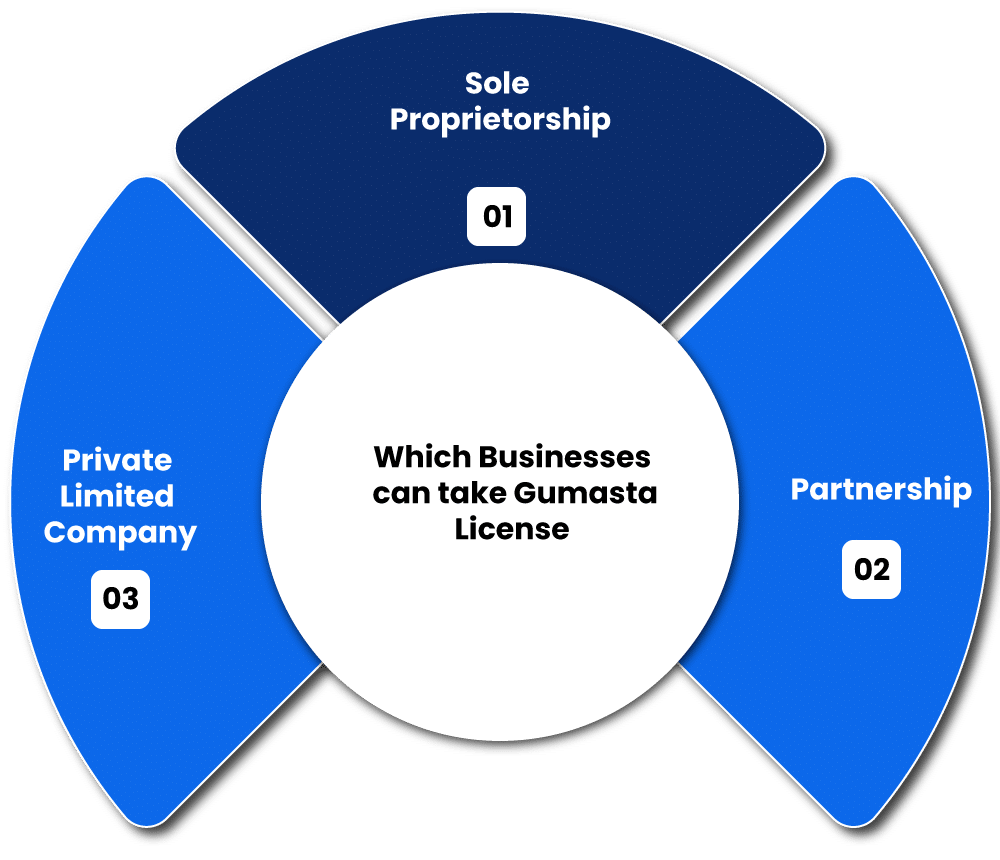

Which Businesses can take Gumasta License?

The following businesses are eligible to take Gumasta License:

Gumasta License Online Registration Procedure?

The following are the steps that you need to follow for the registration of Gumasta License under the MP Shop and Establishment –

- The registration can be done by accessing the official website

- Choose the registration Procedure as an Individual or an organization

- Provide all the details like your phone number and email address

- An OTP will be generated on your phone number, complete your portal access by using that OTP.

- Enter your Login and Password for availing the services

- Click on New Registration of shops and establishment, it will generate a challan number and the required fees have to be paid to get the UTN number

- Select the Registration Form i.e. Form A and complete the form by giving all details

- Print the form and Upload all your document required on the platform and submit it to Shop License Dept of Municipal Corporation

- Pay the application fees online.

Now, once the application is submitted the status will show “Under Scrutiny “ which means that your application with an officer is under process and if the application is processed and approved then the status will change to approved and you can download the documents. Application for registration has to be submitted to the Area Inspector within 30 days of starting of business.

In case the application get rejected which is quite often if you do not take professional advice then you have followed the lengthy procedure of checking the reason and then re-upload or reapply with the correct information.

So, it is advisable to take professional help while filing the form for your Gumasta License.

Documents Required for Registration under Gumasta License?

- Copy of Aadhaar Card of proprietor, partner, director

- Copy of the Pan card of proprietor, partner, director

- Address proof( Electricity bill) of proprietor, partner, director

- Application letter in the prescribed format

- Authority letter for business

- Proof of ownership of Property

- If Rented Premises, then Rent Agreement or Lease Agreement

- Partnership Deed in case of Partnership firm

- Prescribed fees for a partnership Firm

- Photographs of proprietor, partner, director

- Copy of Fee Receipt paid earlier

- LLP Agreement of the Partnership

- Any other Document as required by the Authority

Documents Required for Registration under Gumasta License?

Documents Required for Gumasta License

- Copy of Aadhar Card of proprietor, partner, director

- Copy of the Pan card of proprietor, partner, director

- Address proof( Electricity bill) of proprietor, partner, director

- Application letter in the prescribed format

- Authority letter for business

- Proof of ownership of Property

- If Rented Premises, then Rent Agreement or Lease Agreement

- Partnership Deed in case of Partnership firm

- Prescribed fees for a partnership Firm

- Photographs of proprietor, partner, director

- Copy of Fee Receipt paid earlier if

Validity of Registration of Gumasta License

Gumasta License is valid for the period of 1 year and could be granted up to a period of 10 years. Furthermore, after getting the registration you can apply for Gumasta License renewal by submitting an application each year thirty days before the date of the expiry of the registration certificate.

Registration fees under Gumasta License in India

Well, the registration fees for Gumasta license are not fixed and it purely depends from state to state.

Advantages of Gumasta License in India

Well, the fact is that everything is possible under the table, but there are many advantages that will also miss by you if you do not register your business.

- Once you register yourself for Gumasta license, you are eligible to avail al the benefits and tax subsidies under Maharashtra State Government

- It serves as a seal of approval or proof of legal entity which gives you the right to commence your business peacefully in Maharashtra

- Many banks at the time of providing a loan or opening a bank account asks for the Gumasta License.

Hence it is beneficial for your business if you get your Gumasta License at the right time.

The Penalty for Contravention of the Act

Whoever contravenes the provisions of this Act or the rules made thereunder shall be punishable with fine which may extend to one lakh rupees and in the case of a continuing contravention, with an additional fine which may extend to two thousand rupees for every day during which such contravention continues.

(2) If any person who has been convicted of any offense punishable under sub-section (1) is again guilty of an offense involving a contravention or failure of compliance of the same provision, he shall be punished on a subsequent conviction with fine which may extend to two lakh rupees.